Understanding the Debt Snowball Method

What Makes the Debt Snowball So Powerful?

Picture this: you’re standing on top of a snowy hill. You scoop up a small snowball, pack it tight, and give it a push. At first, it seems tiny, almost insignificant, but as it rolls, it grows—bigger, stronger, unstoppable. That’s exactly what the Debt Snowball Method feels like when tackling your debts!

Here’s how it works:

- List all your debts from smallest to largest balance (ignore interest rates for now).

- Make the minimum payments on every debt except the smallest one.

- Throw every spare dollar you can find toward that smallest debt until it’s wiped out.

- Then, roll over what you were paying on the smallest debt to attack the next smallest—and repeat!

Why does this strategy resonate with so many? Simple: quick wins build confidence. Imagine paying off a lingering $300 credit card bill in just a month. Suddenly, you’re fueled by momentum, energized by victory. It’s like crossing items off a to-do list—you see progress, and it feels amazing.

While the math purists might argue for other methods, the psychology behind the Debt Snowball is undeniable. Small steps forward can lead to giant leaps toward financial freedom. Are you ready to watch your money momentum snowball?

Explaining the Debt Avalanche Method

What Makes the Debt Avalanche Method Unique?

If debt has been weighing you down, the Debt Avalanche Method is like a laser-focused game plan, designed for those who want to crush debt efficiently. Here’s how it works: You tackle your debts in order of their interest rates, starting with the one costing you the most (the highest interest). Why? Because those high-interest debts are like greedy little monsters, eating away at your financial progress every day they linger.

Picture this: You list out all your debts—credit cards, student loans, personal loans—and line them up by interest rate, not balance size. You make minimum payments on all, except the one with the highest rate. For that nasty culprit? You throw every spare penny at it until it’s obliterated. Once it’s done, you roll the freed-up cash into the next-highest interest debt. Like a toppling row of dominoes, each victory speeds up the next.

- If your debts feel endless, focus on this method—it saves you money long-term.

- Biggest perk? You’ll pay less overall, keeping more of YOUR hard-earned cash.

This approach is logical and empowering, especially if high interest rates have been your Achilles’ heel!

Differences Between the Debt Snowball and Avalanche Methods

How Each Method Tackles Debt Differently

When it comes to the Debt Snowball and Debt Avalanche, the heart of their difference lies in their approach—and oh, what a difference it makes! Imagine you’re gearing up for a marathon. The snowball method is like starting with easy, short sprints that build your confidence. On the other hand, the avalanche method dives right into the toughest hills to save you time and energy in the long run. Let’s unpack this.

Both strategies provide structure to the chaos of debt—like picking between two powerful tools. Which one will you wield? That depends on your financial personality!

Pros and Cons of Each Approach

Why the Debt Snowball Feels Like a Personal Victory Lap

Picture this: you’re a sprinter dashing toward small, reachable goals. That’s the essence of the Debt Snowball Method. You pay off your smallest debt first, no matter its interest rate, and then roll that payment into the next largest debt. The beauty? It feeds momentum like wind filling a sail.

Pros:

- Quick Wins: Knocking out smaller debts upfront feels rewarding and boosts motivation.

- Simplicity: It’s easy to grasp—no calculators or spreadsheets required.

Cons:

- Costs More: Ignoring interest rates could mean shelling out extra cash in the long haul.

- Patience Required for Big Debts: Tackling a monster loan last might feel like climbing a never-ending mountain.

How the Debt Avalanche Cuts Right to the Chase

The Debt Avalanche Method doesn’t waste time—it focuses on wiping out high-interest rates first. Think of it as the savvy investor’s approach to debt payoff. Sure, progress may feel slower initially, but your wallet will thank you later.

Pros:

– Money-Saving: By minimizing interest, you pay less overall.

– Efficient: This method prioritizes financial logic over emotional wins.

Cons:

– Momentum Delays: Watching balances shrink takes longer, and motivation can dwindle.

– Complexity: Tracking interest rates and crunching numbers might feel like solving an algebra problem before bed.

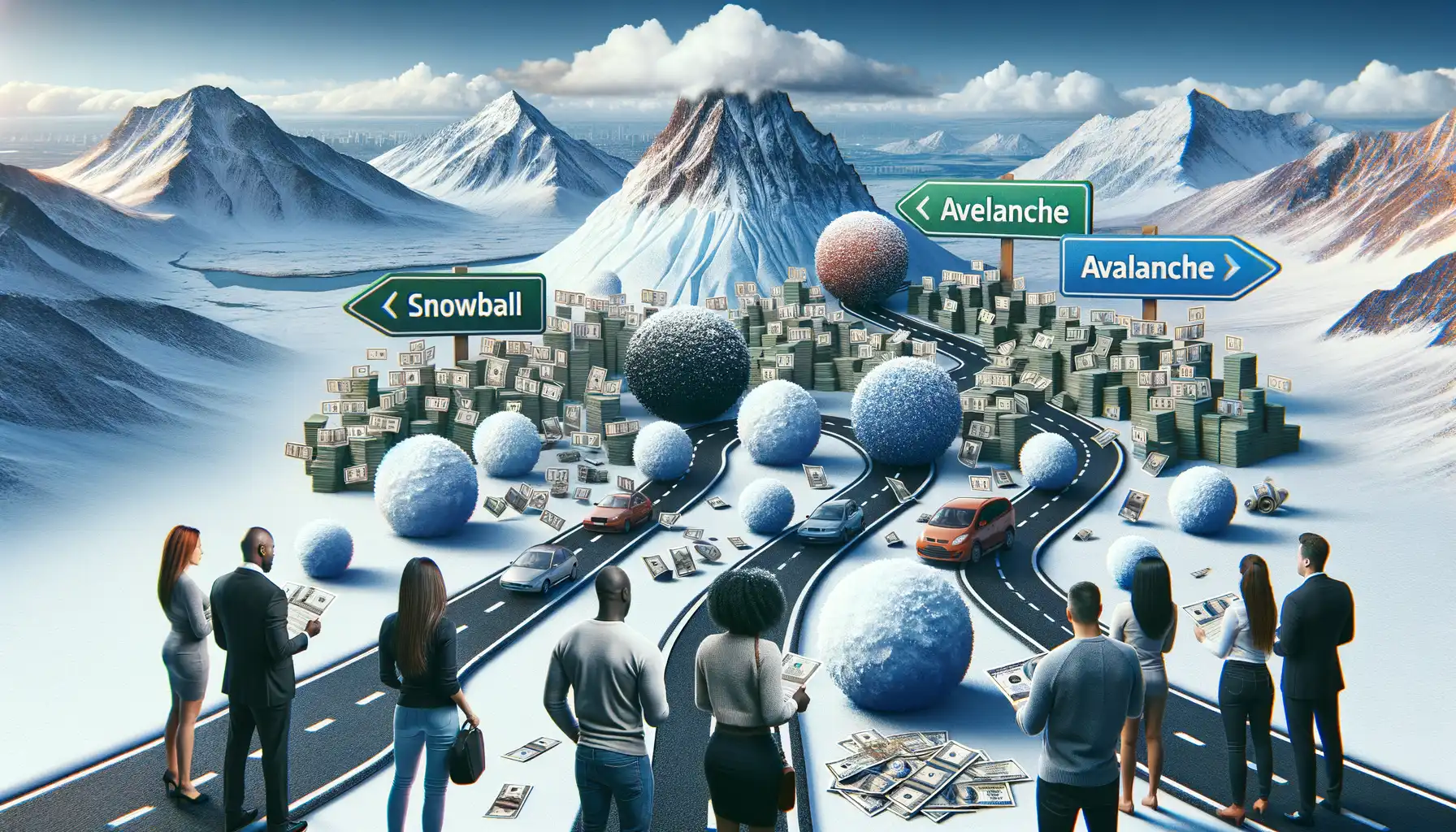

How to Choose the Best Debt Payoff Strategy for Your Situation

Dig Into Your Numbers First

Choosing the best debt payoff strategy isn’t about picking a random method off the shelf—it’s about tailoring a plan that makes sense for *you* and your financial reality. Start by getting crystal clear on the numbers. How much do you owe? What are your interest rates? Are there minimum payments to juggle? Grab a notebook or open a shiny spreadsheet, then list your debts from smallest to largest (for the Debt Snowball) or by highest interest rate to lowest (if you’re eyeing the Debt Avalanche).

Once those figures are staring back at you, ask yourself: What motivates me? If crossing off small balances makes you feel like a financial superhero, the snowball might give you the momentum you’re craving. But if a part of you winces every time you see how much interest you’re paying, the avalanche could cut those costs faster.

Factor in Your Personality and Goals

Finances might feel like cold, hard numbers, but let’s be real—emotions, habits, and life circumstances play a huge role. Consider:

- Your Emotional Wins: Do you need quick victories to stay motivated?

- Budget Flexibility: Could focusing on high-interest debts stretch your monthly finances too thin?

- Lifestyle Goals: Are you prioritizing financial freedom, or are you okay taking it slow and steady?

Ultimately, this is your journey. The “best” method? It’s the one you can stick to!